“Employers are having to compete with record-high starting salaries, increased overheads and pay review requests from employees who are trying equally hard to meet inflated prices”.

Over the past few months, rising costs for food, fuel and living have pushed thousands below the poverty line as people struggle to make ends meet.

The Resolution Foundation has forecast that a typical household’s income will fall by about £1,000 this year, the biggest drop since the mid-1970s.

As prices continue to skyrocket, employers have scrambled to find solutions to help their staff, without draining company finances.

A CIPD report shows that the business case for supporting employees’ financial wellbeing is clear: those who experience money worries are more prone to absence from work. Financial distress can also lead to presenteeism, in which employees attend work but, because of health problems or other personal issues, don’t perform to their usual standards.

During the existing cost of living crisis, pay and benefit professionals should consider whether their organisation’s reward approach is fit for purpose by exploring questions such as:

- What’s happening to workplace financial wellbeing?

- Are we paying our workers a liveable wage?

- Are the organisations in our supply chain paying their workers enough?

- If we can’t increase pay for our employees by as much as the cost of living, what else can we do to reduce the impact of inflation on earnings?

- Can we offer opportunities for low-waged workers to increase their skills and experience so they can take on higher-paid roles?

- Should we invest in the HR technology needed to investigate whether our people are paid fairly?

- Are certain groups of workers, such as female, black, or disabled staff, being affected disproportionately by inflation? If so, what can we do to support them?

- What can we do to protect people from financial scams, such as around pensions?

- How does our benefits package support employee financial wellbeing?

- Should we change how we communicate with employees about pay and benefits?

- Are we directing employees needing help to sources of regulated financial information and guidance?

- Are we clearly communicating our financial wellbeing policy to employees?

The answers to these and other questions, such as what ways are there to improve employee productivity and reduce our cost base, will help employers to better support their people and reduce the impact of poor financial wellbeing for both employers and their workers. Our 2022

Reward management survey explores the impact that the rise in the cost of living is having on employee financial wellbeing and in-work poverty. There’s lots more on what employers can be doing in our ‘

Tackling in work poverty hub’.

How can a SME Positively & realistically Support Mental Health & Wellbeing at Work ?

“Mental health and money are connected as, whether we like it or not, money is a fundamental factor in most of our life choices,” says Dannielle Haig, director and business psychologist at leadership development consultancy DH Consulting.

While you may not be able to give your people a ‘pay rise’ you can look to positively support your staff by supporting their mental health and wellbeing in the workplace.

As a small or medium business, you will not be able to offer all of these suggestion benefits to support your people and ultimately your business. Please do have a look at the list as you may not be aware of them.

Implement an Employee Assistance Programme (EAP)

Employee Wellbeing and COVID-19 Support – Craven HR Services (cravensafetyservices.co.uk)

You may also want to promote any Employee Assistance Programmes (EAP) that you have in place and highlight that your employees can get support in a wider variety of areas such as mortgage advice, financial planning, and debt management in addition to the many other unrelated issues. It is important that whatever support and wellbeing initiatives you do have in place are well communicated, making it really clear to your employees what they are and how they can be accessed.

Offer retail and discount schemes

With the cost of food rising, having the ability to claim a discount off a weekly shopping bill can really help salaries go a little bit further. There are also usually special discounts available for branded clothes retailers or even for expensive purchases such as home furnishings where a small discount can add up to a significant sum of money saved.

Offer Free Breakfast / Lunch

Sounds weird right? Offering free food does not even need to be a constant factor. It can be a collective meal at the pub at the end of the week or something to celebrate reaching targets or milestones.

Free food might seem unnecessary at first glance, but it is actually a very welcome benefit for most. It is cheaper than many other perks that you could offer but goes a long way in benefiting both employees and the business as a whole. So, why not order some Friday afternoon donuts and see what effect they have on morale?

Allow flexible and remote working

Remote working, even one day a week, could make a significant difference to a person’s financial situation, saving on the cost of fuel or public transport. Removing the need to commute entirely could mean that employees are able to potentially relocate to an area with a lower cost of living. Remote workers would also benefit from other forms of cost saving including food, clothing, childcare and pet care.

Help mitigate transport costs

Does your company offer a cycle to work scheme? Those employees who live close enough to their workplace to cycle rather than drive could save on fuel costs. Workers taking this option would also gain financially, as cycle-to-work schemes operate as a salary sacrifice employee benefit, with the cost of the bike taken off their gross salary resulting in paying less income tax and National Insurance. This may offset some of the NI rise that has kicked in.

Offer a one-off cash payment

Providing you have the budget available you could consider offering employees an amount of cash to cover certain costs, such as the energy required to work from home. Some employers have gone as far as offering up to £700 to cover the rise in energy expenses with bills expected to jump by an average of 54% or £693 a year from April.

If you are considering this as a potential option, you would need to consider whether it is a one-off discretionary gift or as part of monthly wages, taking into consideration the tax and pension implications for both the employee and the organisation.

Salary sacrifices

Asking employees to give up part of their pay every month may sound counter-intuitive but it can make financial sense. Budgets can be boosted and costs off-set if the money is used on cycle-to-work schemes, electric vehicle leasing, or interest-free season ticket loans.

Sell back unused annual leave

Many employers are choosing to give staff the option of receiving money for any unused annual leave, as an alternative to carrying it over to the following year.

While employees should be encouraged to take their annual leave, receiving extra income from a few days they have not taken could be a significant help.

Be ‘Mindful’

It is also important for employers to understand that employees with certain protected characteristics may be more affected by the cost-of-living crisis than others. Younger people tend to be on lower wages than older employees, and women are still more likely to be paid less than men. In addition, many people with disabilities are being significantly impacted and may need additional assistance.

Cost of Living Payment – GOV.UK (www.gov.u

For SME’s ideally, we would suggest implementing the following (as a start);

- Stress Risk Assessment – Legal Requirement

- Wellbeing in the Workplace Policy

- Employee Assistance Programme (EAP)

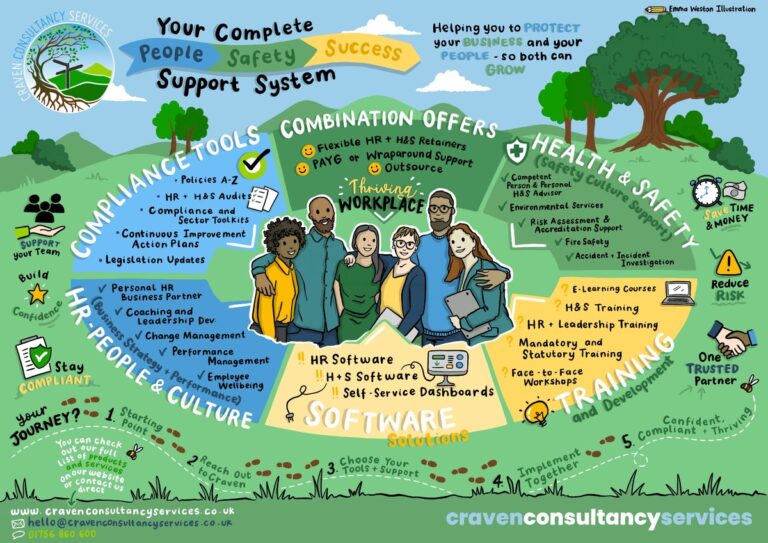

If you need help to implement your Health & Wellbeing Strategies, please get in touch with us for a free-no-obligation chat.