The Autumn Budget 2024 brings impactful changes for businesses across the UK. And small to medium-sized enterprises (SMEs) face unique challenges with the updated regulations.

On October 30, 2024, the autumn budget was announced. Chancellor Rachel Reeves set out her seven main priorities as follows:

1 – Restore economic stability

2 – Increase investments and build new infrastructure

3 – Ensure all parts of the UK can realise their potential

4 – Improve employment prospects and skills

5 – Launch long term modern industrial strategy – expanding opportunities for SMEs to grow

6 – Drive innovation and protect record funding for research and development

7 – Maximise the growth benefits of clean energy

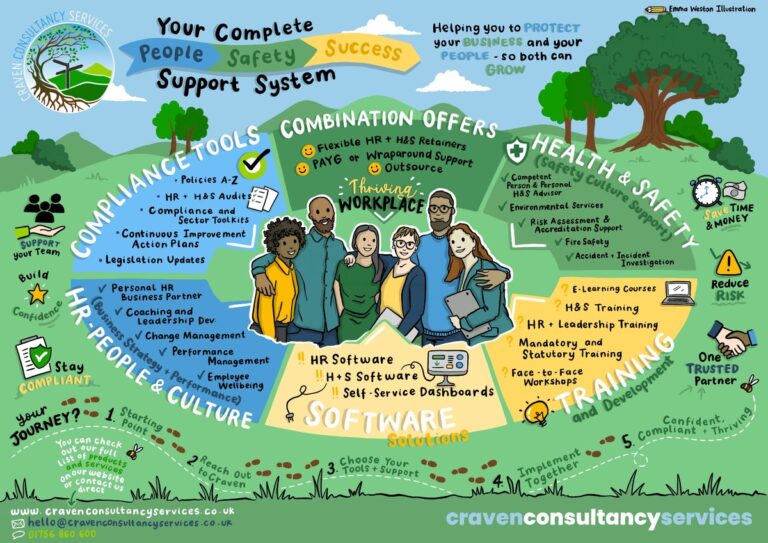

How can HR Consultants Support SMEs Post-Budget

As SMEs navigate these Budget changes, HR consultants can play a vital role in helping SMEs

- to adapt;

- meet compliance requirements;

- and make strategic workforce adjustments.

Here’s a consolidated guide on how HR consultants can support SME

Navigating Compliance and Digital Transformation

- Digital Payroll Transformation: HR consultants can help SMEs select and implement payroll software that complies with the new digital reporting requirements for benefits in kind. Thus, reducing the risk of non-compliance penalties and improves payroll efficiency.

- Benefits Compliance and Simplification: By auditing current benefits packages, consultants can help SMEs streamline offerings and simplify reporting. This ensures compliance and makes benefits more manageable and impactful for employees.

Inclusive Hiring and Veteran Employment Strategies

-

Leveraging Veteran NIC Relief: HR consultants can integrate veteran hiring into SMEs’ workforce strategies, benefiting from the NIC relief while adding valuable skills and diversity to the team.

- Talent Sourcing for Veterans: Consultants can help SMEs connect with veteran recruitment channels and create veteran-friendly onboarding processes, making the hiring and retention of veterans more accessible and effective.

Encouraging Sustainability with Green Incentives

- Fleet and Vehicle Policy Adjustments: With the reclassification of certain vehicles and CCT increases, HR consultants can review vehicle policies and encourage SMEs to consider zero-emission or hybrid options, optimizing tax benefits while promoting environmental responsibility.

- Sustainable Benefits for Employees: HR consultants can help SMEs develop green benefits packages, such as incentives for electric vehicles, public transport allowances, or carpooling programs. This not only aligns with government incentives but also appeals to eco-conscious employees and customers.

Impact on business owners and employment costs

Business owners will feel unfairly picked on. The revenue raising is almost all coming from entrepreneurial activity. It’s a big increase in spending, with employers principally paying for it.

Those employers that have large workforces of mainly lower-paid employees are particularly badly hit. The extra employers’ national insurance is an extra £615 per employee on the first £9,000 of earnings. The additional employment allowance will help those with fewer than 10 employees, but those with larger workforces face a big increase in their costs from April 2025.

Manifesto promises around there being no rise to income tax, VAT or employee National Insurance were confirmed. In fact, from 2028/29 income tax thresholds will be uprated in line with inflation again – lifting the previous government’s freeze. The heavily rumoured increase of the minimum wage to £12.21 was also confirmed.

A rise to employers’ National Insurance

From April 2025, employers will pay 15% in National Insurance on their employees, a rise of 1.2 percentage points.

There is also a reduction in the secondary threshold for when employers must pay this – decreasing from £9,100 to £5,000.

To help support smaller businesses with this rise, Reeves announced an increase in the employment allowance – extending the amount employers can claim back from their National Insurance bill from £5,000 to £10,500.

The chancellor confirmed this means some 865,000 employers won’t pay any National Insurance on their employees next year and around 1 million will pay the same as they have previously or less.

Capital gains tax increase

Capital gains tax will see thresholds increase next year, with the lower rate rising from 10% to 18% and the higher rate rising from 20% to 24%.

SMEs currently have access to business asset disposal relief and it was rumoured this might be removed. That turned out not to be the case as Reeves announced the relief available on the sale of business assets will remain at 10% this year, rising to 14% in April 2025 and 18% in 2026/27.

So while the relief rates will increase this parliament, they will maintain a significant gap compared to the general capital gains thresholds.

Permanent relief on business rates

To help high street businesses, Rachel Reeves announced permanent lower business tax rates for retail, hospitality and leisure businesses.

The current 75% discount to business rates is due to expire in April 2025. It will be replaced by a permanent discount of 40%, up to a maximum of £110k per business. This will be paid for by a higher multiplier on the most valuable properties.

It was also announced that the small business tax multiplier will be frozen next year.

Corporate tax roadmap unveiled

The budget confirmed the government’s commitment to cap corporation tax at 25% for the duration of this parliament. This makes the UK’s corporation tax rate the lowest in the G7.

More freezes and cuts

Here’s a roundup of some of the other announcements that may impact your business:

-

Fuel duty is frozen for another year

-

From April 2026, the first £1m of combined business and agricultural assets will not incur inheritance tax

-

Alcohol duty for off-draught alcohol will increase in line with the retail prices index (RPI), while draught rates will be cut by 1.7% which is about 1p off the pint

-

The current rates of R&D relief will remain in place

1. Understand how the announcements will affect you

It can sometimes be difficult to read past headlines and know how various announcements will impact your business directly. Take the time to digest the news and work out how you might be personally affected. For example, the National Insurance rise may sound alarming, but if you have fewer than five members of full time staff on the national living wage, you won’t pay any NI.

2. Take advantage of relief now

If you’re thinking about selling business assets, it might be worth acting sooner rather than later. Business asset disposal relief will remain at 10% until April 2025, before it increases to 14%.

3. Prepare for new business rates

With the introduction of new permanent business rate discounts of 40% set to replace the current temporary 75% discount when it expires next year, it’s essential to reevaluate your financial plans. Adjust your budgets accordingly and consider price increases where needed to offset these changes. Be sure to communicate any adjustments to your customers, so they understand the reasons behind potential price hikes. You can use the government’s table here to help work out what rates you’ll pay.

4. Explore R&D relief

As research and development relief will remain in place, consider allocating resources to innovate your products or services. This could enhance competitiveness and potentially open up new revenue streams.

Get Britain Working

The Government also announced that they will publish a “Get Britain Working” whitepaper which aims to get those who are unemployed back into work.

Protecting workers

The Budget also cemented the Government’s view on protecting working people from unfair dismissal and safeguarding them from bullying in the workplace.

National Living Wage to rise in April

Ahead of the budget, the chancellor revealed yesterday (29 October) that the National Living Wage (NLW) will increase by 6.7 per cent – a pay rise for over 3 million workers.

The change, due to come in in April, will see the hourly rate for NLW workers go from £11.44 t

Uplift to carers’ allowance

In order to “help those with additional caring responsibilities”, Reeves announced that the amount carers can earn while receiving the £81.90 per week allowance will be increased to the equivalent of 16 hours at the NLW per week.

The increase, which Reeves said is the largest since carers’ allowance was introduced in 1976, will mean carers will be able to earn over £10,000 a year while receiving the benefit.

Preparing your business

The question must be asked: can businesses handle this change?

We always advise businesses to prepare well before any changes come into play to avoid being caught out by non-compliance.