The dramatic hike in inflation has intensified existing pressures placed on small & medium businesses (SME), causing added stress for owners and managers.

- Seven in 10 (69%) small and micro business owners say the cost-of-living crisis is affecting their mental health, according to a joint survey by the free PR platform Newspage.

- Of those surveyed, 14% of small business and charity owners responded that the cost-of-living crisis is having “a very negative effect” on their mental health.

- Two thirds of Britain’s small business owners say the last two years have been the most challenging since they started their venture.

- Nearly half (47 per cent) fear the next 12 months could prove even more difficult.

Although the immediate cost-of-living crisis, with the lack of consumer spending and hefty fuel price increases, is seen as the biggest threat, other challenges include maintaining a steady cash flow (29 per cent), managing their own mental health (18 per cent), and coping with the increase in cost of raw materials (17 per cent).

This year’s PayPal Business of Change report is not all doom and gloom, however.

In fact, one in five SMEs agree that the last two years have had a positive impact on their ability to manage their financial wellbeing, with 56 per cent feeling more financially savvy, 27 per cent feeling back in control of their business, and one in five (21 per cent) feeling more empowered as a business owner since improving their financial knowledge.

So says PayPal in its latest Business of Change report.

How can you budget for high costs and inflation?

Speak to an accounting consultant to get a run down of your existing assets and liabilities. Then, use the results of this conversation to make decisions about what expenditures you can afford to divest in.

If you’re short on money, installing free small business accounting software is a low-budget strategy to get your own analysis of the figures.

Longer-term, organisational tools like these can ensure that you remain compliant with HMRC and avoid costly mistakes.

Move to a remote or hybrid working model

Switching to a remote working policy has multiple cost benefits.

The average cost of a UK office per person, per annum is £7,353. That’s a huge chunk of revenue that could be saved by introducing a home-working policy.

Coworking is typically more economical than traditional office space. It gives tenants greater flexibility should you run into financial difficulty.

Plus, renting an office space means you won’t need to take on responsibility for common infrastructure, such as cleaning or security services.

Hybrid working is a flexible working model which allows employees to work from a variety of different locations. The idea is a progression of flexible and fully remote working, created by a desire from employees to split more of their time between the home and office. The new trend towards hybrid working is largely the result of the Covid-19 pandemic, where many workers found themselves going into the office one or two days a week—if at all.

Audit your staff

Increased National Insurance rates, coupled with an increase in the minimum wage, mean it might not be feasible to keep your current staff levels.

If you’re in need of more staff and are unable to afford hiring new employees, carry out a review into your staff. Analyse productivity levels to see how roles might be better-optimised.

Performance-based incentives like a reward program might be a good idea to introduce here.

Redundancies are of course a highly-undesirable option. But another way to limit labour costs without causing redundancies is to reduce staff hours to short-time working.

For example, you might ask an employee to work a three-day week, instead of a five-day week.

Reducing a worker’s hours is an entirely legal process. But please do remember: you can’t make any changes to an employee’s contract without them first agreeing.

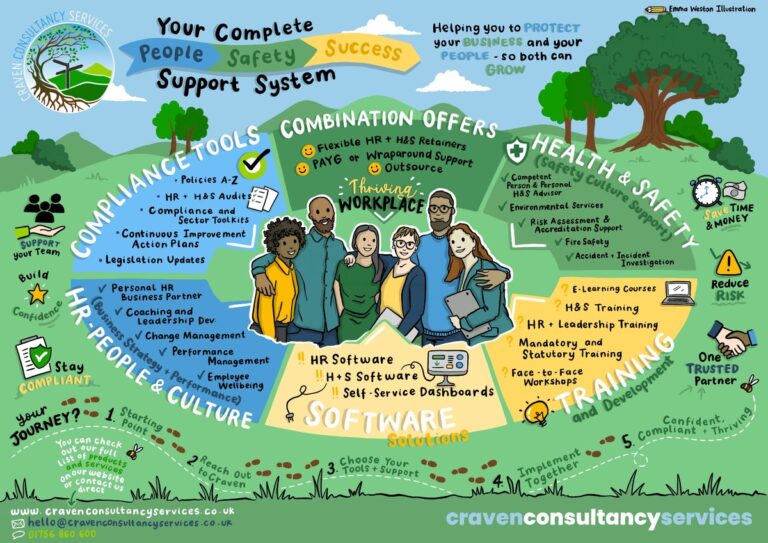

Get in touch now to see how we could help you Work Smarter with a free 30 minute no obligation call with Our HR Consultant Dee Newton 07852 151113.