2022 Employment Law Changes- Review

For the first time since the outbreak of the covid pandemic, 2022 was a return to relative normality, and a refocus on general employment laws. As a result, we saw a number of new rights introduced, removed, and proposed, making it a busy year for legal changes.

Sickness certification

A change to fit notes that happened last year was the decision to allow a wider group of medical professionals to issue fit notes, in place from 1 July 2022. Already from 1 April 2022 fit notes no longer had to be physically signed by a doctor, and from 1 July nurses, occupational therapists, pharmacists and physiotherapists could certify and issue fit notes. However, this did not mean that it was possible to visit a local pharmacy and come away with a fit note: they still could only be issued by one of the above professionals working in a hospital or clinical setting, such as a doctor’s surgery.

Employment related payments

2022 also saw the introduction, and swift repeal, of the “health and social care levy”. This 1.25% increase to national insurance contributions, brought in on 6 April 2022, was designed to fund the NHS, health and social care. Once Boris Johnson resigned, however, Liz Truss, who briefly served as Prime Minister, was quick to undo this, and it was removed from 6 November.

Agency workers allowed to cover for striking workers

The government proposed a number of ways to tackle industrial action, and there are still plans that may yet come into place, such as minimum staffing levels for national infrastructure during strike action. One major change that did come in from 1 July was the repeal of the ban on employers using agency workers to cover for striking workers.

How long this change will remain in place is unclear, as unions have been granted permission to raise a Judicial Review of this law over the lack of consultation prior to its introduction.

Right to work checks go digital (permanently)

Another piece of law that came into force last year was one that enabled employers to instruct a third-party Identity Service Provider (IDSP) to carry out digital identity checks for British and Irish nationals, through the use of Identification Document Validation Technology (IDVT). This put the temporary measures introduced during covid on a permanent footing, albeit in a changed format.

Ban on exclusivity clauses extended

A further legal change that was introduced, on 5 December, was the extension of the ban on the use of exclusivity clauses in contracts that guarantee the employee equal to or less than the lower earnings limit, currently set at £123. This ban means that employers who were trying to circumvent the pre-existing ban for zero hours contracts by guaranteeing a small number of weekly hours could no longer do so and opens up a group of employees to a range of new employment opportunities.

2023 Statutory Payment Updates

National Living Wage rises by nearly 10% and other increases to rates and limits

The National Living Wage will rise to £10.42 from April 2023, an increase of 9.7%. This is the largest increase to the NLW since its introduction in 2016 and reflects the steep rise in inflation and cost-of-living crisis. Employers may find they employ more people on the cusp of NLW rates and therefore may need to pay greater attention to NLW compliance.

Statutory sick pay will go up to £109.40 in April (from the current rate of £99.35) and the weekly prescribed rate of statutory maternity pay (and pay for other types of leave) will be £172.48 (up from £156.66).

The rate for statutory maternity, paternity, adoption, shared parental and parental bereavement pay will increase to £172.48 per week (previously £156.66). The rate for statutory sick pay will increase to £109.40 per week (previously £99.35).

|

Rate from April 2023 |

Current rate (April 2022 to March 2023) |

Increase |

| National Living Wage |

£10.42 |

£9.50 |

9.7% |

| 21-22 Year Old Rate |

£10.18 |

£9.18 |

10.9% |

| 18-20 Year Old Rate |

£7.49 |

£6.83 |

9.7% |

| 16 – 17 Year Old Rate |

£5.28 |

£4.81 |

9.7% |

| Apprentice Rate |

£5.28 |

£4.81 |

9.7% |

| Accommodation Offset |

£9.10 |

£8.70 |

4.6% |

Employment Law Changes

Employment Bills

The Government may not have brought forward an employment bill in 2022, but there are now an unprecedented number of private members’ bills before Parliament dealing with employment.

Remember, as an employer, you have the option to include all UK bank holidays as part of your statutory holiday entitlement. But this is not a requirement. If you do contractually provide all bank holidays as an entitlement then you should also allow time off for the King’s Coronation. rights.

All the Bills mentioned below have now received Government backing, so it is a fair assumption that most, if not all, of them will make it onto the statute book in the course of 2023.

The Retained EU Law (Revocation and Reform) Bill

By the end of 2023, the Retained EU Law (Revocation and Reform) Bill aims to abolish all EU law that is not specifically reinstated or replaced . This may affect a number of EU-derived secondary legislation, including the Working Time Regulations, Agency Worker Regulations and TUPE.

There are concerns around whether the end of 2023 will provide enough time to reform these laws, although there is a potential extension to June 2026 but no later.

First, there are three Private Members’ Bills that appear to have Government backing and will presumably become law with little or no controversy.

- Enhanced redundancy protection

Pregnant women and new parents to get enhanced redundancy protections – GOV.UK (www.gov.uk)

The Protection from Redundancy (Pregnancy and Family Leave) Bill would extend enhanced protection against redundancy (which currently applies only during maternity leave) so that it also applies during pregnancy and for a defined period after returning to work.

2. Neonatal leave and pay

Parents whose babies require neonatal care to receive paid leave under new law backed by government – GOV.UK (www.gov.uk)

The Neonatal Care (Leave and Pay) Bill would create a new framework to support parents of premature or sick babies by providing neonatal leave and pay. Full details of the new rights would be set out in regulations. Under current proposals, there would be an entitlement to one week’s leave for each week that their baby is in neonatal care, up to 12 weeks. The leave would be tacked onto the end of an employee’s maternity or paternity leave and paid at the usual statutory rate and rights would be extended to employees taking adoption and shared parental leave.

3. Allocation of Tips in Hospitality

The Employment (Allocation of Tips) Bill aims to require employers in the hospitality sector to make sure that all tips, gratuities and service charges that they receive from customers are paid over to workers in full without deductions.

Flexible working: day 1 right to ask

#Flexfrom1st – flexible working to be a day one right to request – Craven Consultancy Services (cravensafetyservices.co.uk)

As it stands, employees can only make a statutory request to work flexibly after 26 weeks. Separately from the private members’ bills mentioned above, the government has committed to making the right to request flexible working a “day 1” right. The timetable for this change is currently unknown.

Harassment at work

The Worker Protection (Amendment of Equality Act 2010) Bill would introduce two changes to increase the protection of workers from harassment. It would impose a new duty on employers to take all reasonable steps to prevent overtly sexual harassment in the workplace, as well as restore protection against third-party harassment (of all types).

Carer’s Leave

Whilst we are still awaiting exact details of this bill, we are expecting Government to announce the right for employees who are providing care, or who are arranging care for family members or friends, to have up to 1-week unpaid leave per year. This will be a “day 1 right” and employees will be protected from dismissal or detriment due to taking this leave from the start of their employment.

All these Bills are currently scheduled to reach their report stage in the House of Commons in January or February 2023. After that, there would need to be a third reading in the Commons, before the Bills go through a similar approval process in the House of Lords.

Other Potential Changes

Other potential post 2023 employment law changes include:-

- Ethnic Pay Reporting

- The extension of the right of shared parental leave to grandparents

- Replacement of the General Data Protection Regulation (GDPR)

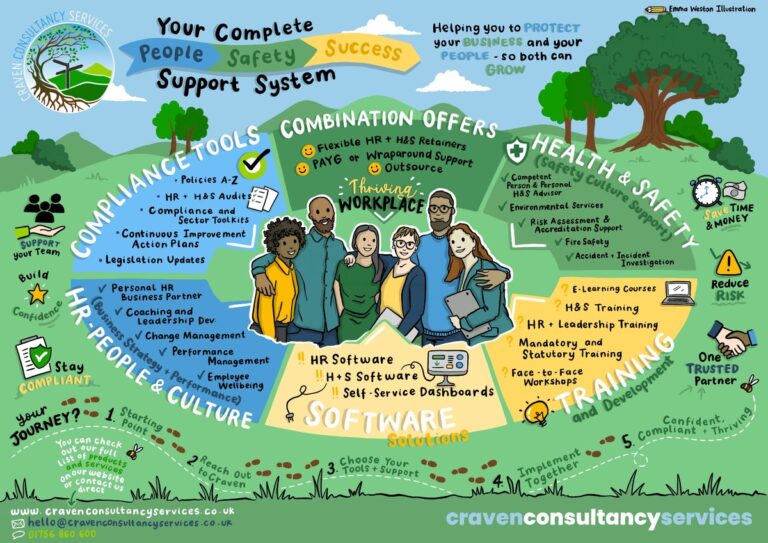

Get expert advice on HR in 2023 with Craven HR Services

Our HR Services frees you from admin, reduce your legal risk and give you more time to grow your business.